Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=231651297

Browse in-depth TOC on "Single-Use Bioprocessing Market"

739 - Tables

61 - Figures

595 - Pages

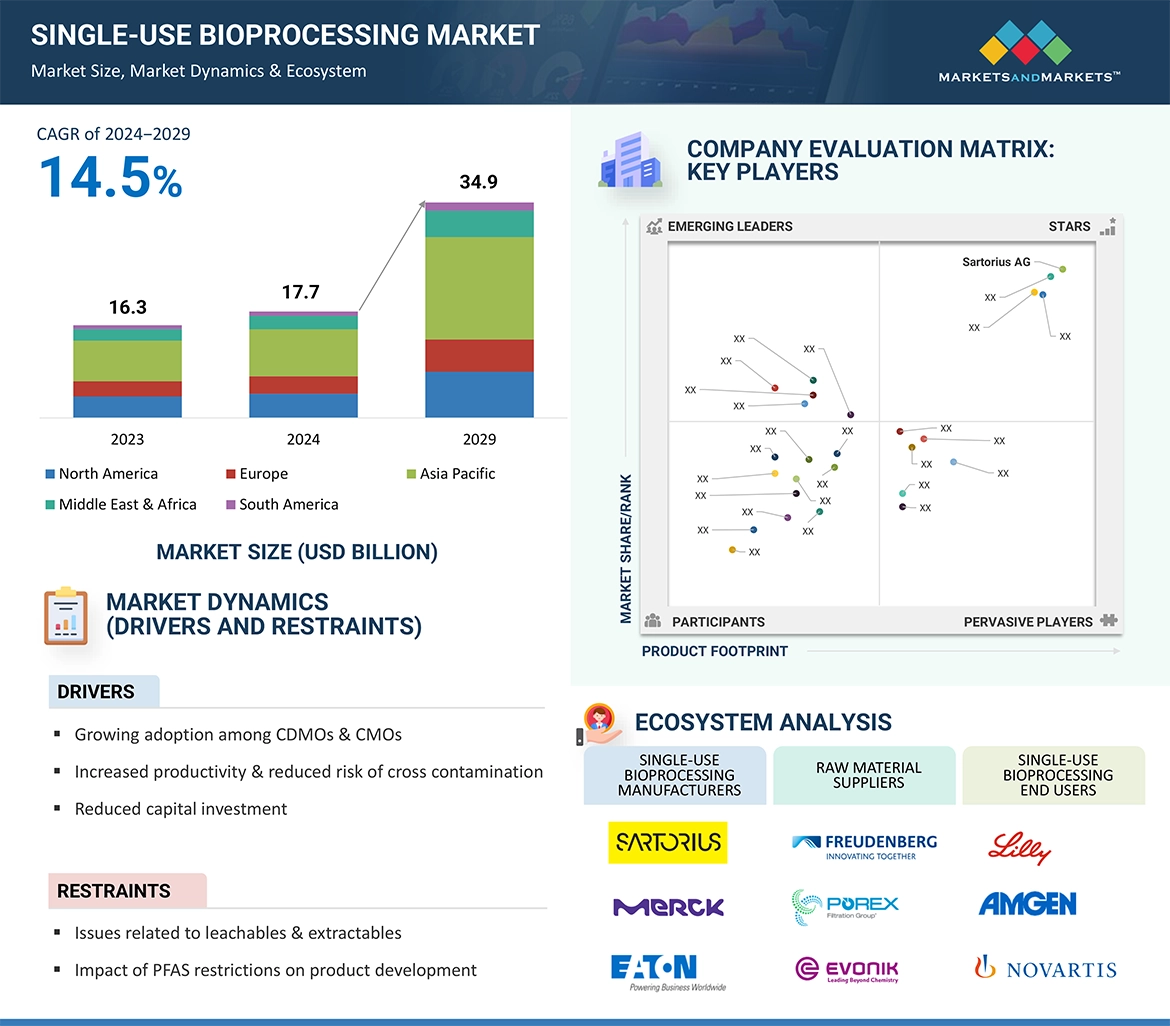

Global Single-Use Bioprocessing Market Dynamics

Driving Force: Improved Productivity and Contamination Risk Reduction

Single-use bioprocessing systems optimize operations by replacing extensive cleaning procedures with disposable components. This accelerates product substitutions and transitions, boosting equipment utilization and overall production throughput. By minimizing downtime and enhancing efficiency, these technologies meet escalating biologics demand, accelerating new therapy launches, and market expansion. Their closed, disposable design minimizes microbial and cross-contamination risks between batches, ensuring product purity and consistency, complying with regulatory standards, and enhancing consumer confidence in biologic drug safety and efficacy.

Challenges: Leachable and Extractive Hurdles

Leachables and extractables, migrating from single-use materials into biopharmaceutical products, pose risks to quality, safety, and compliance. Their interaction with drug substances or formulations can degrade products, alter efficacy, or induce toxicity. Identifying, characterizing, and mitigating these substances demands extensive analytical testing and risk assessment, adding complexity and cost to development and manufacturing processes.

Opportunity: Emerging Market Potential

While mature markets embrace single-use technologies, emerging economies like China, India, Brazil, and Mexico offer significant growth opportunities. Increased healthcare needs, biopharmaceutical infrastructure investments, and supportive policies create fertile ground for expansion, making these regions key targets for single-use bioprocessing market players.

Challenge: Standardization Deficiency

The lack of standardization across single-use designs hampers adoption and efficiency. Variability in components and designs complicates integration, compliance, and supply chain management. Inconsistent quality and performance across manufacturers impact reproducibility and product quality, hindering widespread implementation.

Global Single-Use Bioprocessing Industry Ecosystem Analysis

The ecosystem comprises raw material suppliers, product manufacturers, and end users like pharmaceutical and biotechnology firms, CMOs & CROs, and academic institutions. Manufacturers offer bioreactors, filtration systems, chromatography equipment, and consumables, forming a critical part of the bioprocessing landscape.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=231651297

Single-Use Bioprocessing Market Segment Insights

Dominance of Single-Use Bags & Containers in 2023

In 2023, the single-use bags and containers segment emerged as the frontrunner in the single-use bioprocessing industry. These components offer a disposable alternative to traditional glass and rigid plastic carboys in various bioprocess applications. They enhance process reliability by minimizing the risk of cross-contamination between batches and products. Additionally, they eliminate the need for time-consuming clean-in-place (CIP) and sterilization-in-place (SIP) operations, optimizing capacity utilization. The expanded application of single-use bags across biomanufacturing processes is a key driver for the market's growth in this segment.

Upstream Bioprocessing Segment Takes the Lead

The upstream bioprocessing segment claimed the largest share of the single-use bioprocessing market in 2023. This dominance is attributed to the widespread adoption of single-use bioprocessing in biopharmaceutical formulation, particularly supporting upstream bioprocessing. Furthermore, the growing demand for biologics such as cell and gene therapy and monoclonal antibodies (mAbs) further fuels the growth of this segment.

Regional Insights: North America Leads the Way

North America emerged as the largest regional market for the single-use bioprocessing industry in 2023, followed closely by Europe and the Asia Pacific. This leadership position is supported by several factors, including the presence of key biopharmaceutical research and development facilities in the region and the rising demand for essential biopharmaceutical products like monoclonal antibodies, vaccines, gene therapies, and cell therapies. These factors collectively contribute to North America's significant share in the single-use bioprocessing market.

Recent Innovations in Single-Use Bioprocessing Industry

Cytiva's Xcellerex Magnetic Mixer:

Cytiva unveiled the Xcellerex magnetic mixer in April 2024, a breakthrough single-use mixing system available in capacities of 2,000 and 3,000 liters. Specifically designed for large-scale manufacturing processes of monoclonal antibodies (mAb), vaccines, and genomic medicines, this system promises enhanced efficiency and scalability for biopharmaceutical production.

Merck KGaA's Ultimus Single-Use Process Container Film:

In April 2023, Merck KGaA introduced the Ultimus single-use process container film, a cutting-edge solution designed to offer unparalleled durability and leak resistance. Tailored for single-use assemblies utilized in bioprocessing liquid applications, this innovative film sets new standards for reliability and performance, ensuring seamless operations and product integrity in biopharmaceutical manufacturing.

For more information, inquire now! Inquire Now